- Per My Last Thought

- Posts

- Trump’s Tariff Strategy: A Shortcut to Stagflation?

Trump’s Tariff Strategy: A Shortcut to Stagflation?

Trump’s use of tariffs as a negotiation tool has created global trade uncertainty. While they pressure trade partners, tariffs risk stagflation—rising inflation with slowing growth. History shows such policies can trigger long-term instability that outlasts any administration.

Tariffs as a negotiation weapon is a high-stakes strategy. Tariffs have always been a part of economic policy, but under President Donald Trump, they’ve taken on a new role: a high-stakes bargaining chip. Instead of being used to selectively protect key industries, Trump has wielded tariffs as a broad threat – a tool to pressure trade partners into making concessions. This is just like a military standoff, but instead of missiles, the weapons are taxes on imported goods. And just like in military strategy, economic threats don’t only hit the target – they cause collateral damage. Supply chains are disrupted, industries struggle, and prices rise.

Take Canada and Mexico, for example. Just weeks ago, Trump revived the threat of tariffs against both countries, framing it as a necessary step to strengthen U.S. economic resilience. The argument is that by reducing reliance on imports, particularly in key industries, the U.S. could better withstand global supply chain disruptions and external economic shocks. Tariffs won’t fix that problem, investment in local industry could. But this move wasn’t just about self-sufficiency – it was also a strategic bargaining chip. Canada and Mexico didn’t suddenly become economic threats; the tariffs served as leverage to push for stricter immigration controls and border security cooperation.

In short, tariffs have become more than just a trade tool, they’re now the ‘big scary red button’ being used to influence broader political issues. But what happens when temporary tariff threats become long-term policies? That’s when things get risky.

Reading the Financial Times this morning, I saw that Nobel Prize-winning economist Joseph Stiglitz has warned that if tariffs are pushed too far, the U.S. could enter stagflation – a mix of rising inflation and slowing economic growth. I couldn’t agree more.

Why tariffs could lead to stagflation

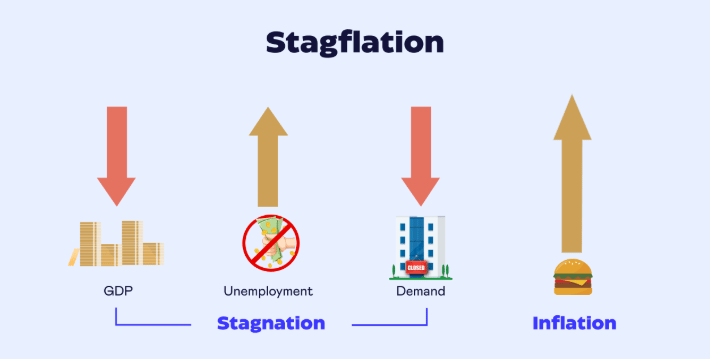

Stagflation is one of the worst economic scenarios – a painful mix of high inflation, stagnant growth, and high unemployment. Normally, inflation happens when the economy is booming, and prices rise due to strong demand. But stagflation is different – it’s when prices increase while the economy weakens.

Why is stagflation so difficult to fix? Because the usual solutions contradict each other – raising interest rates fights inflation but slows growth, while cutting rates boosts growth but worsens inflation.

Tariffs, unfortunately, create the perfect storm for stagflation:

Goods become more expensive. A tariff on steel? Every car and appliance costs more. A tariff on electronics? Say goodbye to cheap phones and laptops. These higher costs don’t stay with businesses – they’re passed on to consumers.

Uncertainty slows investment. When businesses don’t know whether tariffs will increase or decrease, they hesitate on hiring, expansion, and major investments. When businesses pause, economic growth slows.

Retaliation is more than probable. Other countries don’t just sit back when the U.S. raises tariffs – they impose their own tariffs on American goods. This hurts U.S. farmers, manufacturers, and tech companies who suddenly face new trade barriers overseas.

Inflation is pushed higher. As businesses pass their increased costs to consumers, inflation rises. If the Federal Reserve steps in and raises interest rates to control inflation, borrowing gets more expensive, further slowing economic growth.

This isn’t just a hypothetical scenario – it’s exactly what happened in the U.S.-China trade war in 2018/19. When Trump imposed tariffs on Chinese goods, China retaliated by cutting its U.S. soybean imports by 75%, leaving American farmers struggling. Meanwhile, U.S. manufacturers paid higher prices for raw materials, making their goods less competitive globally.

If the U.S. keeps escalating tariffs, more industries will be affected, and the economy could find itself trapped in rising prices and falling growth – stagflation in action.

History warns… Stagflation is a scary thing

I wasn’t around in the 1970s, but from everything I’ve read and heard, stagflation during that decade was an economic nightmare. The U.S. economy was hit by a perfect storm of skyrocketing oil prices, sluggish economic growth, and relentless inflation. Prices kept rising, but wages failed to keep up, squeezing household budgets and crippling consumer confidence.

The Federal Reserve had to raise interest rates to over 15% just to bring inflation under control. Eventually, inflation came down, but the high rates triggered deep recessions and mass layoffs. If you want a sense of how painful it was to recover from stagflation, Alan Greenspan’s book, The Age of Turbulence, lays out exactly what happened – years of economic sacrifices, drastic policy shifts, and painful recessions before stability returned.

The difference is that back then, stagflation was caused by external forces, i.e. an oil crisis and global supply shocks. If tariffs push us into stagflation today, it will be entirely self-inflicted, the result of policy decisions rather than outside circumstances.

The long-term: Impact on trade and alliances

Tariffs don’t just affect today’s economy – they reshape global trade for decades. For years, countries like Japan, Germany, Canada, and the UK saw America as a stable economic partner. But as tariffs become more unpredictable, many are now reworking their trade strategies to reduce dependence on the U.S. The European Union is strengthening ties with China. Japan is expanding trade agreements with Southeast Asia. Canada and Mexico are looking beyond the U.S. for key exports.

Here’s the problem… Once supply chains shift, they don’t just snap back. If Germany builds deeper ties with China or Canada strengthens trade with Europe, those changes outlast any single presidency.

America’s economic strength has always been built on trust and stability in global trade. If that reputation erodes, the U.S. could find itself increasingly isolated in the global economy – much like how Trump’s tariff policies have sidelined the WTO, weakening the very system the U.S. helped create to enable free trade.

How far will trump go? What happens next?

The real concern isn’t just whether Trump’s tariffs will backfire today – it’s whether they will become a permanent fixture of global politics, making international trade more uncertain, more volatile, and ultimately harder to reverse. Moreover, if this tactic is pursued, what happens after the dust settles? Once alliances are rattled, once trade relationships shift, and once global supply chains adapt to bypass the U.S., can the American economy still thrive?

Because at the end of the day, the real test isn’t whether Trump’s tariff strategy “works” in the short term – it’s whether the U.S. economy can sustain itself in the long run, once the world has adjusted.

Tariffs might seem like a short-term bargaining tool, but they set a precedent for how economic power is wielded. If this approach becomes the norm, it won’t just be the U.S. using tariffs as a weapon – other countries will follow suit, escalating trade wars, slowing down economies, and increasing global instability. This could further disrupt the already fragile world order, pushing it into greater uncertainty and economic fragmentation.

Disclaimer: This write-up (like all my other write-ups) reflects my personal opinion based on recent events and possible outcomes. It is a potential scenario, not a prediction. Economic conditions evolve, and so can my perspective with new developments.